🌦️ WeDeAn – Weather Derivatives Analyzer

WeDeAn (Weather Derivatives Analyzer) is a Python and Streamlit-based application for analyzing weather data and valuing HDD/CDD-based weather derivatives. It integrates DWD (Deutscher Wetterdienst) datasets, computes degree-day indices, and applies burn analysis to estimate the theoretical payoffs and fair values of weather options.

👉 Check out on GitHub

🚀 Features

-

Load and process DWD weather datasets: Automatically reads and cleans station data (e.g., TMK, RSK, SDK) and prepares it for analysis.

-

Calculate Heating and Cooling Degree Days: Converts daily temperature data, the core indices used in weather derivatives.

-

Adjust for climatic trends: Optionally detrend long-term CDD/HDD series to remove warming or cooling biases.

-

Burn analysis pricing: Calculates historical payoffs and fair values of HDD/CDD-based options using actual observed weather.

-

Interactive visualizations: Displays time-series plots, rolling averages, payoff curves, and fair value results - fully integrated in a Streamlit dashboard.

📊 High-Level Process

- Load Dataset – Select a weather station and import its historical data (TMK, SDK, RSK, etc.).

- Clean & Filter – Restrict data to a selected observation window (

Observation length) and remove years with incomplete data. - Compute Degree-Day Indices – Aggregate daily HDDs/CDDs into seasonal accumulated values.

- Trend Adjustment (optional) – Remove long-term temperature trends.

- Calculate Payoffs – Compute annual option payoffs from accumulated indices.

- Price Options (Burn Analysis) – Estimate fair values as the discounted historical mean of those payoffs.

🧮 Core Concepts

HDDs (Heating Degree Days)

A measure of how much and for how long the outside air temperature is below a base temperature (commonly 18°C). Used to estimate heating demand - colder weather means higher HDDs and greater energy use.

Formula:

HDD_i = max(0, T_base – T_i)

CDDs (Cooling Degree Days)

A measure of how much and for how long the outside air temperature is above a base temperature (commonly 18°C). Used to estimate cooling demand - hotter weather means higher CDDs and more electricity use.

Formula:

CDD_i = max(0, T_i – T_base)

Fair Value of CDD/HDD Options

The expected (average) payout, discounted to present value.

Can be estimated by:

- Historical simulation (burn analysis)

- Statistical modeling

- Monte Carlo simulation

Pricing Using Burn Analysis

A transparent pricing method using historical weather records.

- Compute the HDD/CDD index for each historical year.

- Calculate the option payoff (e.g., call/put) for each burn year.

- Take the average discounted payoff across all years as the fair value.

Assumption: Past temperature distributions represent the future (unless trend-adjusted).

▶️ Run the Application

1. Clone the repository

git clone https://github.com/trholy/wedean.git

cd wedean

2. Build and run docker container

docker-compose up --build

3. Open in your browser: The app will launch at http://localhost:8501

Example Output

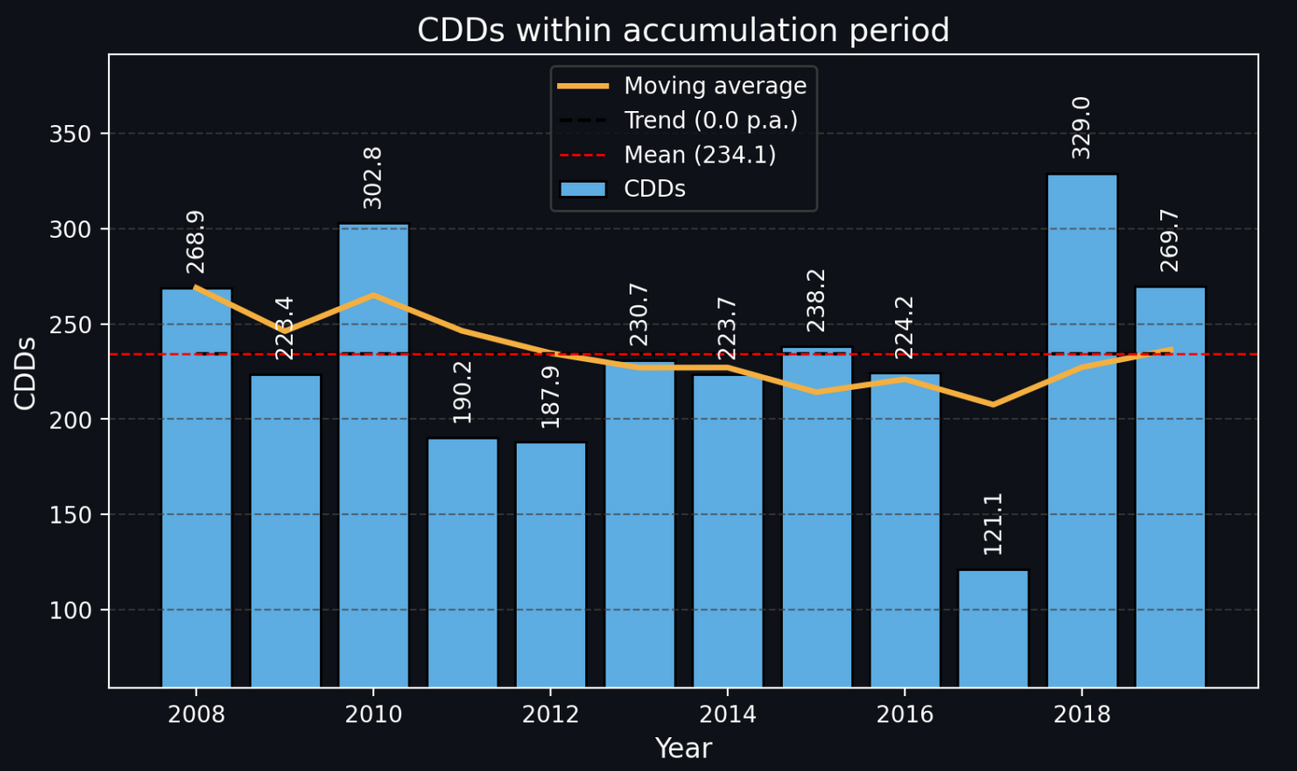

- Berlin Marzahn 2020

- CDDs

- Trend adjusted

- Observation length: 12 years

- Moving average length: 5 years

- Interest rate: 2.0%

- Tick size 100$

📂 Project Structure

├── .dockerignore

├── .gitignore

├── Dockerfile

├── LICENSE

├── README.md

├── datasets

├── docker-compose.yml

├── pyproject.toml

├── setup.py

├── src

│ ├── __init__.py

│ ├── wedean

│ │ ├── calculation

│ │ │ ├── __init__.py

│ │ │ └── calculation.py

│ │ ├── data_handling

│ │ │ ├── __init__.py

│ │ │ └── data_handling.py

│ │ ├── plotting

│ │ │ ├── __init__.py

│ │ │ └── plotting.py

│ │ └── utils

│ │ ├── __init__.py

│ │ └── utils.py

└── streamlit-app

├── app.py

├── requirements.txt

└── utils.py

📜 License

This project is released under the MIT License. You are free to use, modify, and distribute it with attribution.