📊 RiskSim – Risk Simulation Framework

Back during my master's studies, I became fascinated by quantitative risk management—one of my favorite courses. As a student assistant, I implemented three risk simulation methods (Monte Carlo, Variance–Covariance, and Historical Simulation) in Python, adapting the Excel examples from our lectures. 🧑💻

A year later, I had the honor of demonstrating this implementation to students and delivering my first lecture, an exciting experience.

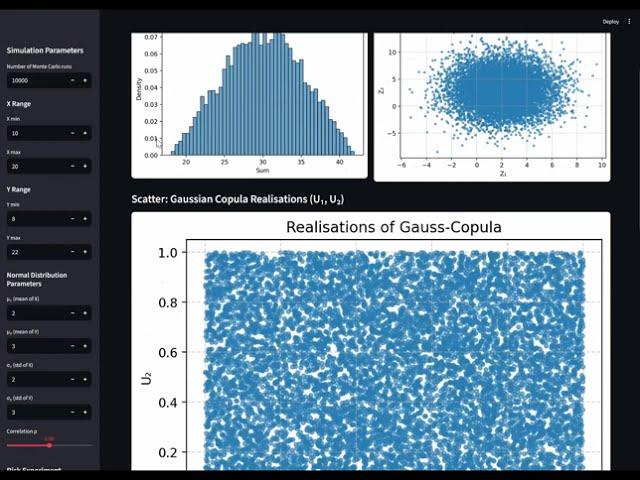

Today, I'm revisiting this project: RiskSim is now structured as a well-organized Python package, leveraging object-oriented design and a Streamlit-based UI instead of Jupyter notebooks. The framework is also containerized with Docker, making it easy to deploy and use. 🚀

🔹 What RiskSim does:

It allows you to model portfolio dependencies and compute risk measures such as:

- Value-at-Risk (VaR) – the loss not exceeded with a given probability

- Conditional VaR (CVaR) – the expected loss beyond the VaR

- Power Spectral Risk Measure – a risk measure emphasizing tail risks

Key features:

- 🧠 Three integrated risk modeling approaches: Monte Carlo (Gaussian Copula), Historical Simulation, Variance–Covariance

- 📊 Interactive Streamlit dashboard to explore dependencies, distributions, and risk measures

- 🔁 Demonstration of Output Variability in Monte Carlo Simulations

- 💻 Flexible configuration of portfolio parameters, correlations, and simulation settings

Watch the demo

⚙️ Try it yourself:

RiskSim is open source and runs in a Docker container.